Loan Management. Made easy.

The market and loans environment over the past few years requires companies to quickly adapt to the changing environment. End-users increasingly resort to the services of credit institutions. To achieve all business goals, creditors strive to maintain quality of service, shorten service delivery times to end customers, and minimize business risks. One of the major mistakes made is investing in obsolete software systems that do not meet the demands of a dynamic market. The specificity of this type of business and the need for secure control coupled with the option of servicing the many products offered requires companies to acquire the right software to accompany the credit organization's employees throughout the life of the loan application until it is reviewed and approved.

The ideal software for servicing the process of applying for and approving different loans should provide:

- Maintenance of all types of credits;

- Automatization of routine processes tailored to the type of credit;

- Ability for integration with external systems;

- Functionality for creating a scoring analysis;

- Pooling information and storing multiple accompanying documents to individual loans.

BankSoft has developed a flexible software system tailored to the needs of individual credit organizations serving the entire process of applying for credit, through its consideration by various credit specialists to the final stage of its approval or rejection. The LoanBox software helps automate the overall business process by allowing every type of credit - from microcredit, overdraft and credit cards to consumer, mortgage and business loans. The ability to integrate with external CRM systems, scoring systems, the ability to retrieve references from external registers CCR, NSSI, GRAO, APIS and others makes the system an indispensable credit assistant, facilitating decision-making at every stage.

New Generation of Software Solutions

The LoanBox credit scoring and approval system provides functionality for servicing the overall process from receiving a loan request through the various stages of its consideration until its rejection or approval. Innovative credit software is designed to automate the processes of compiling, reviewing, approving credit, and retrieving reports. The single electronic archive, which uses the credit software, allows the development of a complete dossier and systematization and classification of information to facilitate the next approval stages. At each stage of the LoanBox credit request, you can retrieve references from external systems - CCR, NSSI, GRAO, APIS. On the basis of predefined settings, the different processing stages of the request by the credit officer require the application of various additional filing documents, which facilitates easier decision making. Each completed and approved credit application is sent to the primary service.

Optimizing the Loan Process

The system LoanBox covers every aspect of the workflow regardless of the type of credit. Depending on the type of credit selected, it is required to enter preset screen forms to fill in the requisite requisites for the credit type. After completing the required information and performing a scoring analysis based on the data entered, the credit application may be targeted for approval and subsequent processing to different units of the credit institution under the internal rules. The review process ends with the refusal or approval of the request, and a credit proposal is prepared upon approval. After a transaction, credit data is automatically exported to the credit institution's core system.

Full Control over Workflow Processes

LoanBox has a visual designer for administering and managing the individual steps in the credit process. In the process of developing the credit review and lending system, BankSoft's main purpose was to build an administrative panel to allow certain users to add new credit products, manage the workflow, determine the different levels of approval and steps for individual products. The software is highly configurable and allows individual companies to create their own business standards and set their own business processes. The Innovative LoanBox Admin Panel provides full operational control, defining work steps, and reducing manual operations errors by introducing different work scenarios for individual products. The administrative panel allows you to specify the required documents during the various stages, to define user groups that have the right to work in separate stages, to specify the maximum processing time in each stage. The ability to fully parameterize the software system allows it to be fully tailor-made to the business requirements of each credit organization.

Reducing Risk my Making Informed Decisions

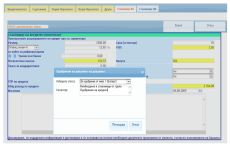

System-provided input control and multiple automated validation and approval operations at certain stages of the credit creation process contribute to a significant reduction in possible manual operations errors and increased performance. An innovative credit creation, review and approval system provides easier and more informed solutions at different stages. LoanBox has its own scoring module that assesses the credit request on the basis of a pre-set weight in each of the input fields and on the basis of queries to external systems or check in pre-loaded registers.

-

Applying

-

LoanBox offers a full set of nomenclatures needed to create a new credit request. It can be created for registered clients of the credit institution as well as for non-bank customers. In case a person request is required, a client of the credit institution LoanBox provides a means of registering it in the organization's main serving system. Depending on the product selected, the requested information from the customer is different.

The main information required is divided into separate tabs:

- Consultant (bank employee);

- Loan information;

- Loan applicant information;

- Loan applicant's employer information;

- Family status of loan applicant;

- Applicant's spouse information;

- Current liabilities;

- Income information;

- Information on moveable and immovable property;

- Bank account statements;

- Finacial assets for collateral;

- Other information.

-

Statement Preparation

-

At each stage of the loan application, the system requires a statement to be given before allowing the next step.

- Ability to add unlimited number of views in one status of statements from different members of user groups;

- Option to introduce individual screen views.

-

Request Processing

-

Depending on the settings you set, credit generation and management software allocates the created requests awaiting post-processing to specific users or a group of users. Additional functionality is sending automatic notifications when there is a request pending processing. Through this allocation tool, the individual user sees only those requests that await his opinion. The possible actions are as follows:

- Review of request;

- Functionality for editing the data in the request;

- Apply additional required documents;

- Moving request to next step of approval;

- Refusal of request - final status and limitation of subsequent processing of the request;

- Printing pre-defined printheads and document.

-

Attaching Additional Documents

-

The system has a single electronic archive and allows you to attach and archive documents to each credit application file. Different documents may be required depending on the settings during the different processing steps.

- Archiving required documents at different stages of processing;

- Archiving retrieved queries;

- Storing additional documents to the request;

- View all attached documents at any time, regardless of the status of the request.

-

Settings Types of Credit Products

-

LoanBox allows adding new types of credit requests and managing the statuses over which the request must pass.

- Creating a new type of credit product;

- Describing the input forms;

- Defingin life-cycle;

- Specify possible statuses and define the order in which they should be processed ;

- Deleting/Editting credit products.

-

Define Stages in Request Processing

-

In this sub-menu the steps that can characterize or define one type of document can be set. Determining the stages determines the sequence through which the processing of a document passes.

- Creating a new stage;

- Drawing up of different scenarios of work - setting out what situations might arise at the appropriate stage and what kind of subsequent processing the request might be;

- Set the maximum processing time for a request at a given stage, allowing the different products to have different times set.

-

User Rights

-

LoanBox provides functionality to adjust the rights of different user groups for different credit products.

- Set up for processing of individual products;

- Define which group of users can view / monitor / edit credit claims;

- An option to indicate at which stage the current user group can handle the request;

- Set maximum time to process a status;

- Signaling when the processing time has elapsed.

-

Settings - Attaching Additional Documents

-

This part of the credit software is designed to set up the required additional documents.

- Option to specify the required documents for different product types;

- Functionality for setting up the required additional documents at the individual processing stages;

- Specify whether the document is mandatory or recommended;

- Set the rights of individual user groups to attach document types.

Core advantages of LoanBox are:

- Extremely easy and intuitive interface;

- Ability to define different types of credit;

- Drawing up scenarios for processing requests;

- Determination of approval stages through which one credit passes;

- Possibility to automate individual stages of credit initiation;

- Automatically target the credit to a responsible unit or employee;

- Internal scoring module evaluating the credit against the parameters entered;

- Retrieving reports from external registers - CCR, NSSI, GRAO, APIS and others;

- Generate different printing forms.